If this is relevant to you, Organise can record sales tax (eg VAT in the UK or GST in Australia).

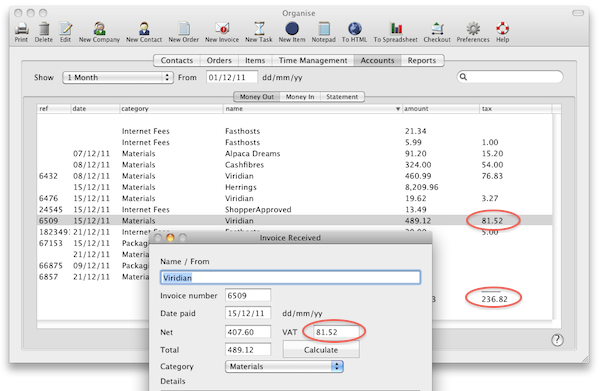

If you have set a tax name and tax rate in the General tab of Organise Preferences, then you will be able to calculate the tax that you have received as part of the payment that you receive for an order, and record the tax that you have paid when you pay your suppliers' invoices as part of the Invoice Received form.

You can get a total of the tax received (collected) and of the tax you've paid for a given period by using the Money in and Money out tabs of the Accounts manager. Both have a column for tax which is totalled at the bottom.

You can then press To HTML or To Spreadsheet to export the report.